It's budget season, and we’re hearing a lot from our private equity partners about how they’re evaluating investments in business development efforts for 2024.

It’s a tighter market after all: as TruSight subsidiary Private Equity Info recently reported, platform and add-on acquisitions have declined in recent years and holding periods are growing longer.

That last point is hiding a crucial takeaway: with holding periods extending, many of our investor partners say that they’re being more mindful of their fund management fees, and as a result, analyzing annual operational costs more closely.

Deal flow is still king, and business development is a primary driver. That critical role isn’t going anywhere. But they tell us that they've had to be smarter about how they're putting those dollars to work. It’s not necessarily about changing the line item, but making sure their teams have the right resources and priorities to be successful.

Based on those conversations, we put together 5 ways that you can make sure your business development team will thrive next year.

Evaluate last year’s annual goals and the channels that helped you achieve them

It’s always a great time to check the data. One question that comes up is whether or not deal flow is being properly attributed in the funnel. Our most successful partners have detailed views of their most viable channels—whether its proprietary or intermediary-led, or if the conversation started through a contact from a new database, M&A event or from their existing network. By tracking the number of top-of-funnel conversations and management meetings through to closed deals, firms are able to see clearly which channels close more efficiently, and where to focus time and spend.

Evaluate and improve your data sources

One trend we’ve heard is that good data is getting expensive, with per-seat subscription prices continuing to rise. With proper tracking in place, attributing deal flow to specific data providers can clarify if those subscriptions are worth their weight, and if they have data sources that are improving the business development team’s efforts. TruSight acquired Private Equity Info in 2022 for that very reason: it was our most viable source of investment bank and intermediary data for our private equity partners.

Reevaluate your most successful events and conferences, and improve your strategy

It’s common to attend the same M&A events year after year—but do you know which ones are the most valuable? And do you have expectations in place to measure their value? Travel and lodging is more expensive than ever, especially when compared to the efficiencies of virtual connections. But we all know that the right meeting at the right event can be a game-changer (which is why we recently published the most prominent M&A events in the U.S. and Canada in 2024).

By creating differentiated metrics, you can more efficiently measure an event’s efficacy. For example, since serendipity matters so much, TruSight evaluates the number of new relationships earned at each event, and budgets accordingly. Meeting face-to-face with our clients is always a crucial bonus for retention, but events have to drive new relationships, as well. And with the right data provider, you can research the attending firms and other regional connections to develop a consistent block-and-tackle strategy, to get more bang for your buck.

Find new ways to balance deal execution and deal origination, as well as sources of deal flow

Firms often find that their team’s focus swings between deal origination and deal execution. First, you focus on marketing to find new deals. Then, there’s a shift to the transaction, which can be time-consuming and require tremendous focus. When a deal closes or dies, the pipeline once again needs attention. Firms are either doing deals or marketing, but rarely simultaneously. Implementing strategies to balance your team’s priorities, while carefully considering the long-term ebb and flow, can have a big impact.

Likewise, consider a clearer understanding of the balance between proprietary and intermediary-led deal-flow sources. Are you investing in proprietary outreach too deeply, and missing deals from intermediaries? Which sources are driving the most opportunities? And is your team better equipped to manage one source, or the other?

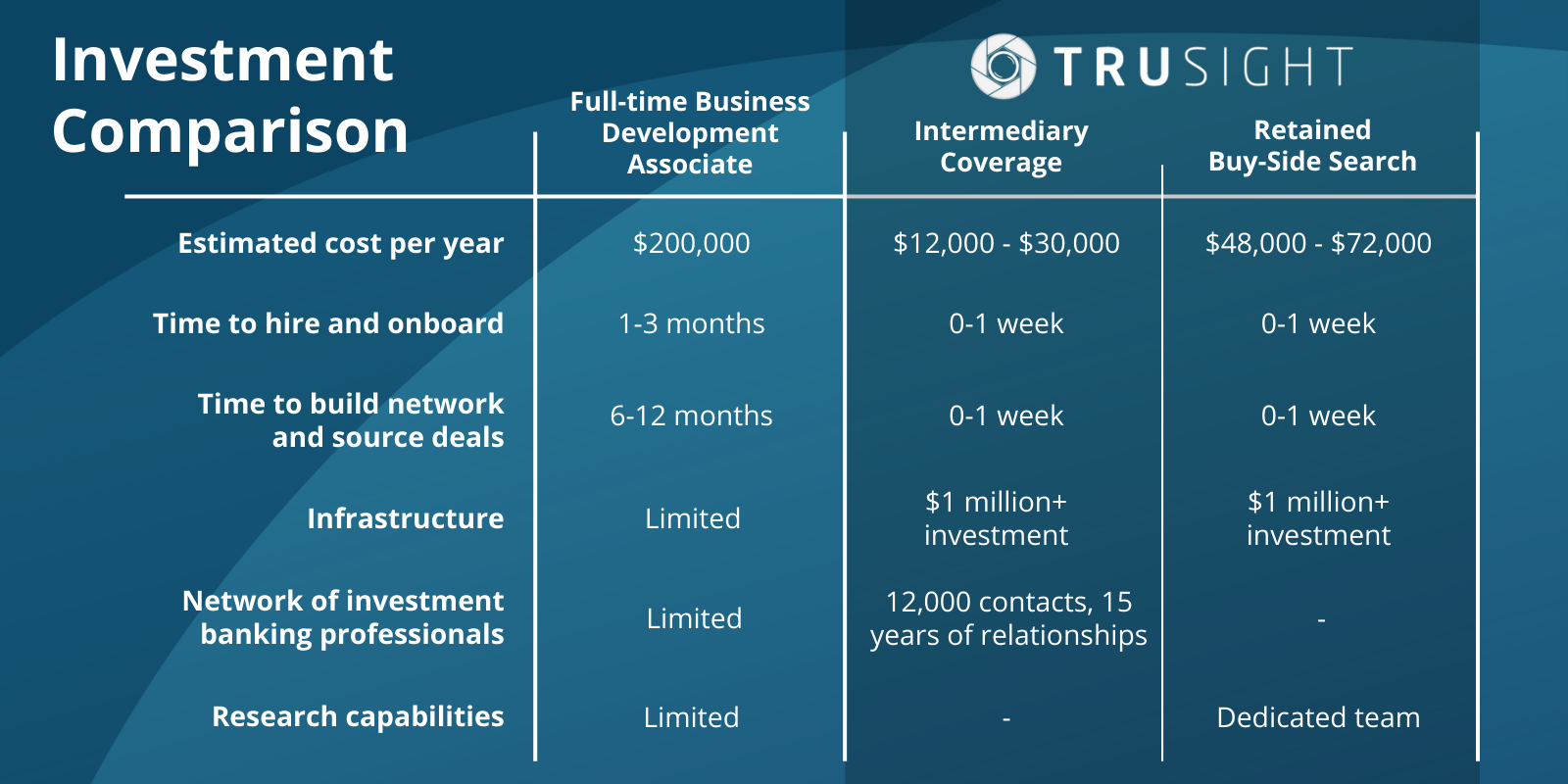

Prioritize your top channels and consider supplemental services for the rest

Once you’ve established clear funnel data and know where to spend your time, it’s even easier to evaluate third-party services to supplement business development efforts. You and your team should be focused on high-priority relationships and making sure deals get done, but not at the cost of missing out on new deals from lower priority sectors.

Consider the Lower Middle Market: a channel that has become increasingly viable. But it’s also huge: we track more than 12,000 people that work at investment banks and intermediaries. For many firms, staying connected with them all is a challenge, especially if your firm doesn’t have team members that are exclusively dedicated to deal origination.

TruSight has spent more than a decade building relationships with these long-tail sell-side groups and perfecting a retained search practice, for private equity firms that are looking to leverage our network and expertise. The result is that through our proprietary and intermediary-led service offerings, private equity firms with small teams can stay focused on deal execution and leave deal sourcing to us.

%20-%20secta.ai.jpg?width=70&name=Dan%20Mahoney%20(1)%20-%20secta.ai.jpg)

.png)