SUMMARY

The shift toward E.V.s continues to show momentum, with the U.S. developing and increasingly adopting policies that will accelerate the production and sales of electric vehicles.

Private equity firms and individual investors have an opportunity to play an essential role in the growth of the Electric Vehicle (EV) market, as it will require substantial investments in related infrastructure, service, and energy.

Key Indicators

- E.V.s increase in new vehicle market US share

- FYE 2021 - 4.8% and through Q3 2022 5.5%

- Major Automotive OEMs eliminating sales of Internal Combustion Engine (I.C.E.) vehicles by 2050 (California and New York by 2035).

- Increased demand from eCommerce delivery, logistics, and shared mobility sectors

- Available subsidies, grants, and tax incentives

- Increased carpool-lane access, increased ranges, better charging infrastructure*

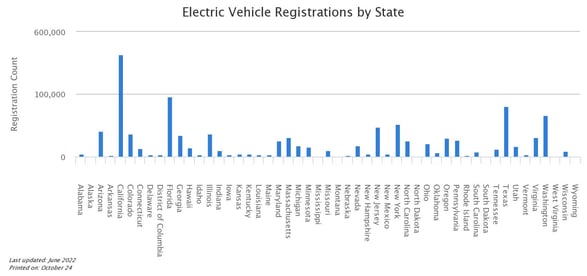

According to Automotive News, electric car registrations jumped 60% in the United States through Q2 2022, despite an overall market decline of 18%.

Deal Sourcing Opportunities in the Electric Vehicle E.V. Industry

The continued push towards a world where electric vehicles are as ubiquitous as their International Combustion Engine (I.C.E.) brethren has seen a flurry of venture capital and private equity investors pile into the industry.

As a result, electric cars will likely take on a more significant role in the auto market over the next few years. The growth in E.V.s can disrupt the entire auto industry, from manufacturing to the service station.

However, this growing sector is moving quickly, an

d the future looks bright for companies operating in the space. With ongoing technological advances and increasing consumer demand, the E.V. industry is on a launchpad to see tremendous growth in the years to come.

Since the current Administration took office, U.S. companies announced investments in electric car manufacturing worth over $36 billion and batteries worth $48 billion. In addition, companies also announced $24 billion for batteries -- 28 times as much as was invested in 2020 -- and over $700 million for E.V. charging infrastructure.

Supported by legislation in California, New York, and other states leading the charge (pun intended), the Biden Administration is also earmarking more than $7 billion to advance the build-out of charging stations throughout the country. But, there are still reliability issues.

One academic study from UC Berkley found only 72.% of 657 public fast chargers in San Francisco were operable. Other E.V. owners have anecdotally opined that frustration with working charging stations is only growing. Like many other industries garnering professional investor interests, the growth may not come from the products but rather the servicing and maintenance. Otherwise, what good is it to build charging stations on every corner if they are out of order?

Several states are moving toward adopting zero-emissions vehicle (ZEV) regulations to speed the adoption of electric cars. In addition, increasing sensitivities among governments to a cleaner environment have increased demand for zero-emission vehicles.

Many U.S. Cities and states are creating their vision and policies for E.V. mobility, adopting zero-emission vehicles and cleaner-car regulations, and adopting more robust approaches to boost infrastructure investments and the electric-vehicle market.

TruSight, LLC can assist buyers and investors in identifying deal sourcing opportunities in the electric vehicle and related services sector. Contact Us for more information on the Electric Vehicle EV Industry, trends, and specific opportunities for your firm.

More Reading for PrivateEquityInfo.com

Private Equity Investing in the Electric Vehicle Charging Stations Industry

%20-%20secta.ai.jpg?width=70&name=Dan%20Mahoney%20(1)%20-%20secta.ai.jpg)

%202.jpg)