TruSight sought insight from investors in the following four areas:

-

Cadence of Deal Flow through LOI to Close

-

Sources of Deal Flow

-

Causes of Deal Process Delay

-

Best Practices in a Tight and Challenging Market

These results are summarized by a quote we received from a PE Partner, “Everything is hard; doing deals is hard. Finding resources for diligence is hard. Recruiting people is hard.”

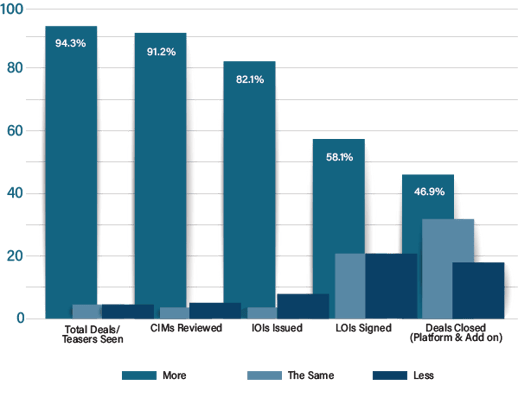

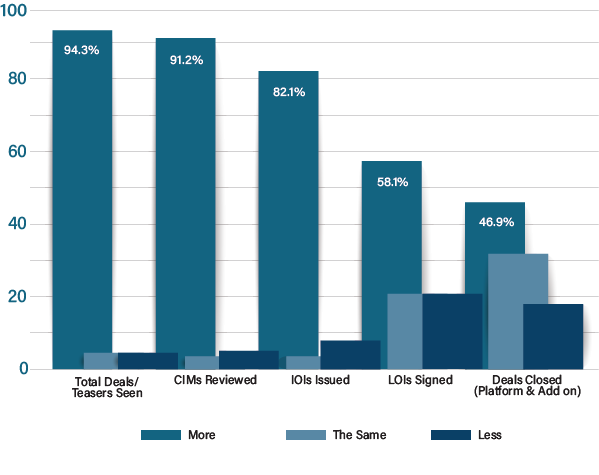

Question one garnered data around changes in deal flow from 2020 to YTD 2021.

Unprecedented Deal Flow:

Everyone is seeing more deals, but less than half of the survey respondents are closing more deals. Consistent with our last survey , most of the firms surveyed said that the number of deals closed remains about the same or even less than in years previous.

Anecdotally, we’re hearing from many investors that they are simply passing early if the target is not a perfect platform or tuck-in fit, to save precious bandwidth pursuing deals more likely to move forward.

One partner at a PE firm suggested a reason for the lower closing rates compared to the volume in the top of the funnel saying, “larger firms are coming down the market to compete with us, but not just on price. They can pull teams together to complete diligence items typically reserved after an LOI is signed, so they’re able to outrun us.”

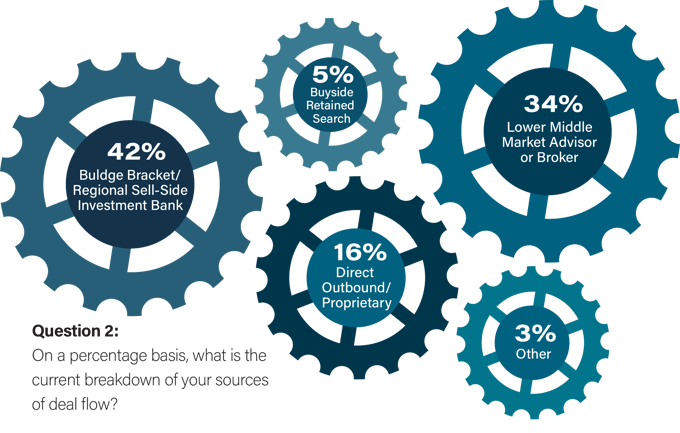

Question two asked participants to share current sources of deal flow by percentage.

Quantity vs. Quality:

Perhaps in response to the quantity conundrum, 21%+ of respondents are taking direct sourcing action to find new deals (the combo of direct outbound and retained) to solve for the quality control of deals that come across their desk. That way firms can focus on the most important tasks, arguably the underwriting of deals.

Having sell side intermediaries responsible for 76% of deal flow simply highlights the need to keep those relationships warm to ensure investors are seeing the most relevant opportunities, early and often.

With that said, creative ways to keep in front of this network are critical to ensure long-term sourcing success. Simply picking up the phone when it rings won’t cut it any longer.

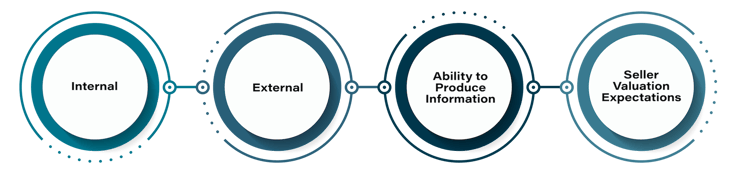

Question three asked respondents to explain reasoning behind deal processing delays.

Even reporting that four main categories are the source of processing delays:

Internal – In order to manage the internal funnel of deal flow, private equity firms are looking for talent more than ever.

External – One of the biggest questions in Q4 of 2021 is whether the outside service provider market has the human capital to process the deluge of deal flow. Buyers are relying on long-standing relationships in hopes they get shoehorned into the schedule, even at short notice. Others are simply taking to the phone lines to find new vendors for these services.

Ability to Produce Information – Timeliness of information and ability to execute diligence request lists has long been something investors may groan about; however, it is ever more so critical in times of high activity. Sellers are coming to market with quality of earnings reports in hand, allowing buyers to prioritize other items before giving their own accountants a peek under the hood.

Seller Valuation Expectations – There are plenty of factors like record levels of buyout dry powder, deals gone to auction, and inordinately high valuations that gridlock companies into paying soaring asset prices (specifically in sectors like technology). Multiples for deals getting done today are at or near record highs. Companies bought at these prices will have to generate more value if they are to make good on return expectations.

The old saying of “pigs get fat and hogs get slaughtered” applies in some situations where sellers are eyeing up purchase prices far above what markets are willing to pay and suffering deals that hit major speed bumps or are shelved outright.

Our final question was a write-in that allowed us to have a discussion around how folks are dealing with the delays mentioned in the prior question.

Strategies for mitigating bottlenecks:

Common themes in this write-in section ranged from conviction to hire internally, engaging in and leaning on relationships with 3rd parties for deal sourcing, diligence help, and deal vetting, and ultimately making sure that time spent is geared towards deals where groups feel most strongly.

%20-%20secta.ai.jpg?width=70&name=Dan%20Mahoney%20(1)%20-%20secta.ai.jpg)