Proprietary deal flow that extends your business development efforts

Retained Buy-Side Search

Discover coveted off-market deals with TruSight's proprietary search service. By reaching out directly to business owners, we source targeted, proprietary acquisition opportunities for clients that need additional bandwidth to supplement their deal sourcing resources.

.png?width=75&height=75&name=Untitled%20design%20(11).png)

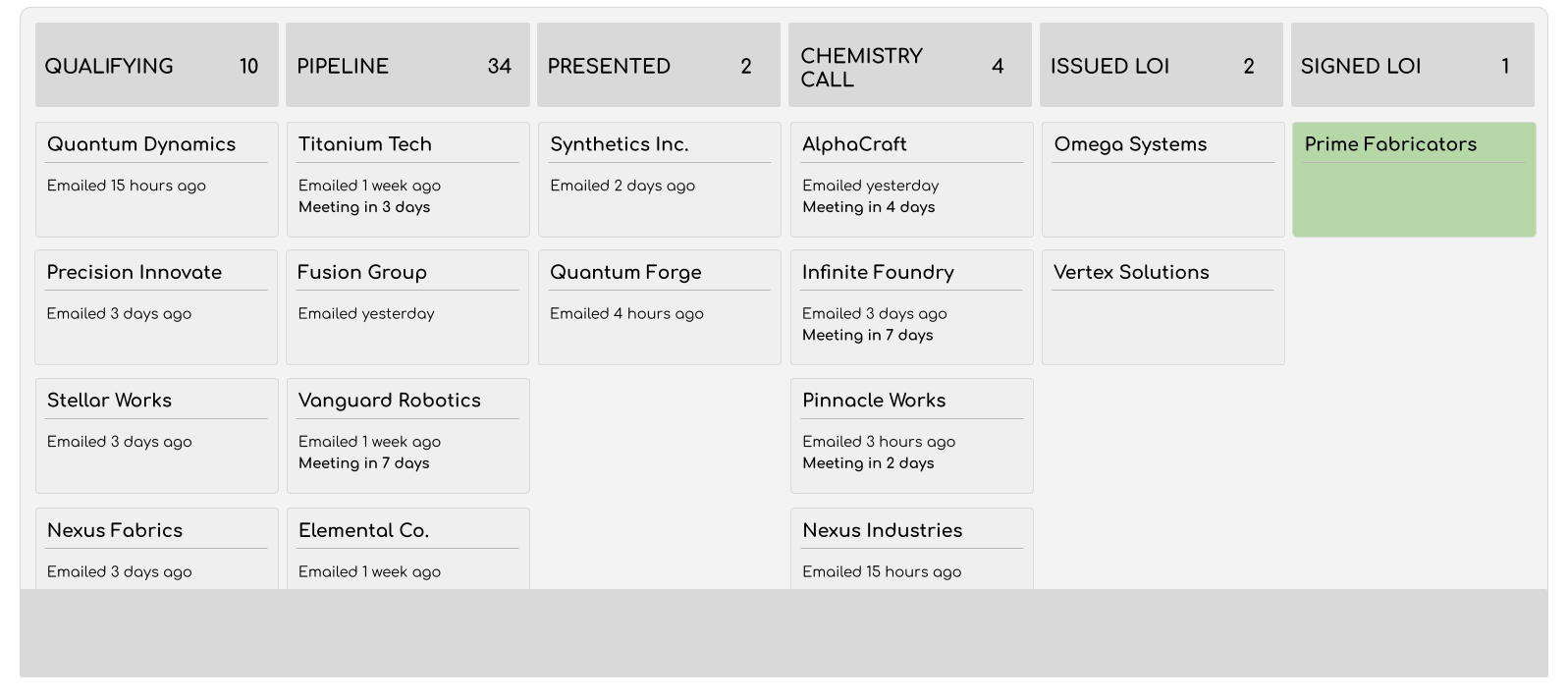

“Always-on” pipeline

We provide a constant flow of vetted opportunities and maintain those relationships so you can focus on closing the deal.

.png?width=75&height=75&name=Untitled%20design%20(12).png)

Expert staff

Our team of senior professionals specializes in deal origination and add-on acquisitions that lead to successfully closed transactions.

.png?width=75&height=75&name=Untitled%20design%20(13).png)

Tech-enabled process

Clients get on-demand access to our deal pipelines to understand new opportunities in real-time.

Our Process

With our “always-on” pipeline, new research is presented throughout the life of a retained buy-side search, meaning a continuous stream of new targets and outreach.

Criteria Strategy

Identify targeting criteria

Market feedback and sample list

Define messaging needs

Drip campaign drafted

Pipeline Activation

Consistent list-building process, using proprietary data

Drip campaign emails begin sending

Receive an ongoing flow of vetted opportunities

Pipeline transparency

Receive regular update calls to review your pipeline of targets, to see where conversations stand and how companies are progressing through the funnel.

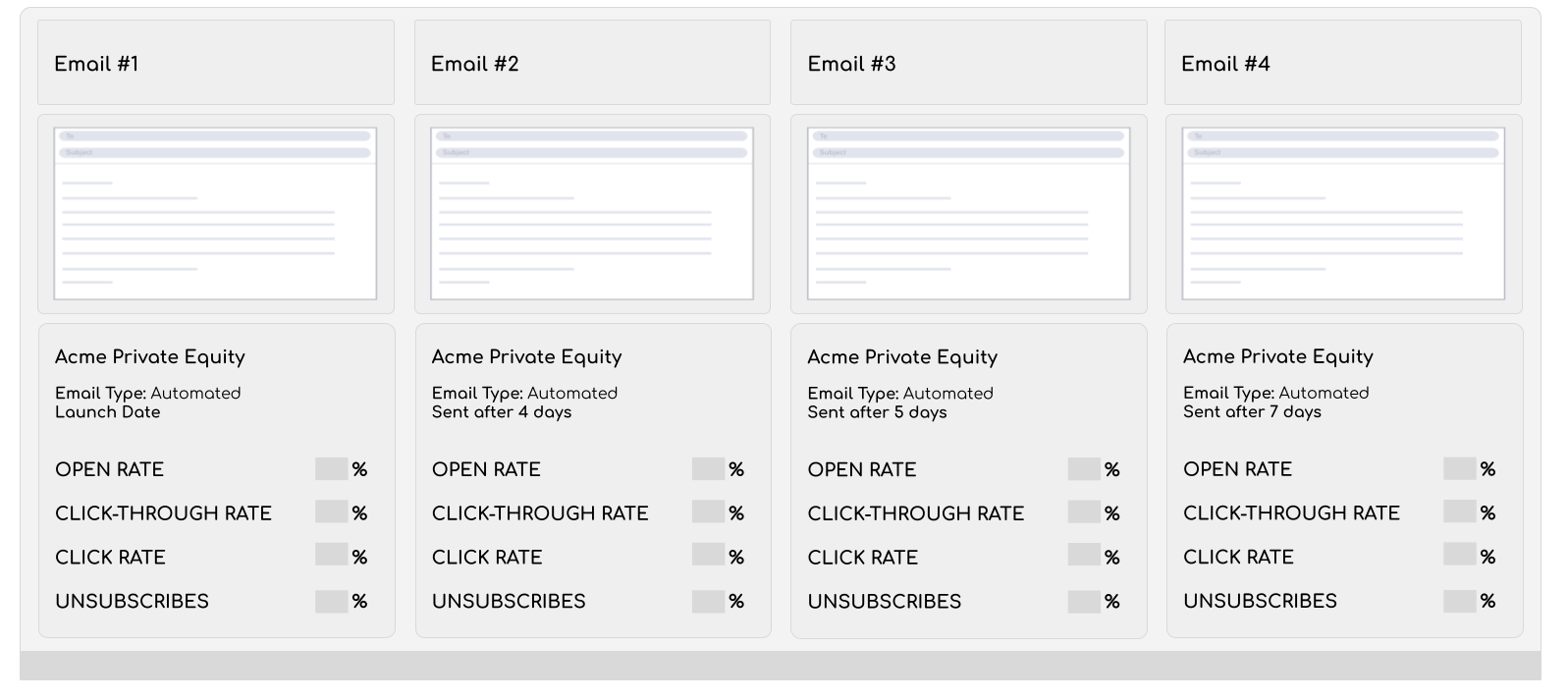

Data-driven outreach

TruSight provides insights into email metrics like open, click, and read rates, as well as metrics around who is engaging the most with your strategy.

Current and Former Clients

Transaction Parameters

U.S. & Canada

Buyout, Majority & Minority Recap, Growth Equity

$5-100 million

Average Deal Revenue

$1-20 million

Average Deal EBITDA

Schedule a call to learn more