Enhance your buyer network and close more deals

Buy-Side Deal Origination that complements your deal process

TruSight has spent a decade building relationships in the Lower Middle Market, establishing buy-side agreements with private equity firms, family offices and strategic acquirers that are actively seeking new investment opportunities. For our investment banker and advisor partners on the sell-side, that means we can expand the distribution of your deals confidentially and transparently, and deliver high-quality introductions to investors.

You keep 100% of your deal fee

Expand distribution of your deals

Access to our investor network gives you and your clients more visibility and confidence.

-1.png?width=75&height=75&name=Untitled%20design%20(2)-1.png)

Gain new and influential relationships

TruSight's extended network of qualified buyers delivers rapid responses and feedback for your deals.

.png?width=75&height=75&name=Untitled%20design%20(2).png)

Control the confidential process

TruSight transparently initiates targeted buyer contact only with the firms that you authorize.

.png?width=75&height=75&name=Untitled%20design%20(3).png)

Benefit from added capacity

Our enhanced buyer coverage allows you to focus on closing deals and securing new seller mandates.

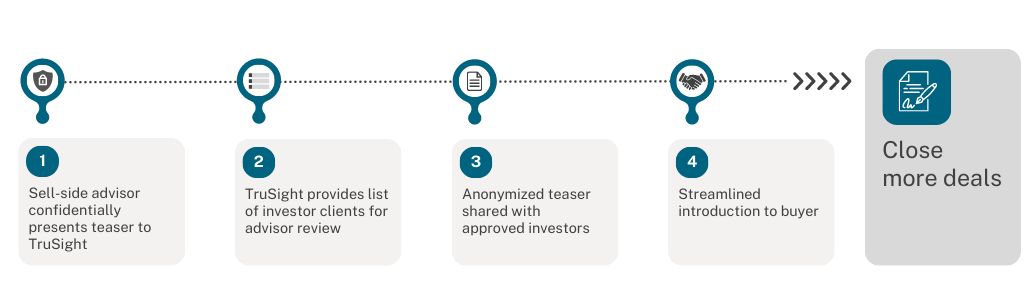

Our process

Investor client criteria

Transaction Types

Buyout / Majority Recap

Growth / Minority Recap

Geography

United States

Canada

Revenue

$10 million to $150 million

EBITDA

$1 million to $25 million

Schedule a call to learn more

Industries that our clients cover

- Agriculture

- Automotive

- Aerospace & Defense

- Business Services

- Consumer & Retail

- Construction & Engineering

- Distribution & Wholesale

- Education

- Food & Beverage

- Financial Services

- Healthcare Products & Services

- Industrial & Manufacturing

- Restaurants

- Software & Technology

- Specialty Chemicals

- Telecommunications

- Transportation & Logistics

- Travel & Leisure